Get started below or book a demo/consult with Mark

Besolo is the first benefits, tax & admin platform for fractionals. Fractionals United members get exclusive discounts and perks.

- NFree LLC or S Corp formation

- NSolo S LLC: 30 day free trial + 10% off for life

- NSolo S Corp: 20% off for life

- N30 day money back guarantee

Book time with our co-founder Mark

Get started now

Solo LLC

With Besolo for LLC, you’ll be using the only all-in-one platform on the market!

$116/month + first month free

$129/month

- Available in all 50 US states!

- LLC formation, EIN & registered agent (if needed - state filing fees not inlcluded)

- Annual tax filings with US-based tax pros

- Standard benefits -- solo 401K & pet insurance

- Task-based compliance calendar

- Integrated accounting, time-tracking & invoicing

- Quarterly estimated tax calculations

- Year end consultations with tax pros

Already have an established LLC?

Solo S Corp

Everything in Solo LLC plus $10K+ in tax savings* with additional benefits options.

$279/month

$349/month

- Currently available in CA, CO, AZ & GA

- S Corp formation, EIN & registered agent (if needed - state filing fees not included)

- Premium benefits access - PPO healthcare, life, accident

- Standard benefits -- solo 401K, dental, vision, pet

- Hands-on business tax filings with US-based tax pros

- Task-based compliance calendar

- Integrated accounting, time-tracking & invoicing

- Year end & onboarding consultations with tax pros

Already have an established S Corp?

“Being a business of one should be easy, but it’s not today. My Co-Founder and I were self-employed for over a decade each – Besolo is the platform we always dreamed of.”

Mark Jackson

CEO / Co-Founder @ Besolo

See Besolo yourself

The all-in-one platform for independent professionals

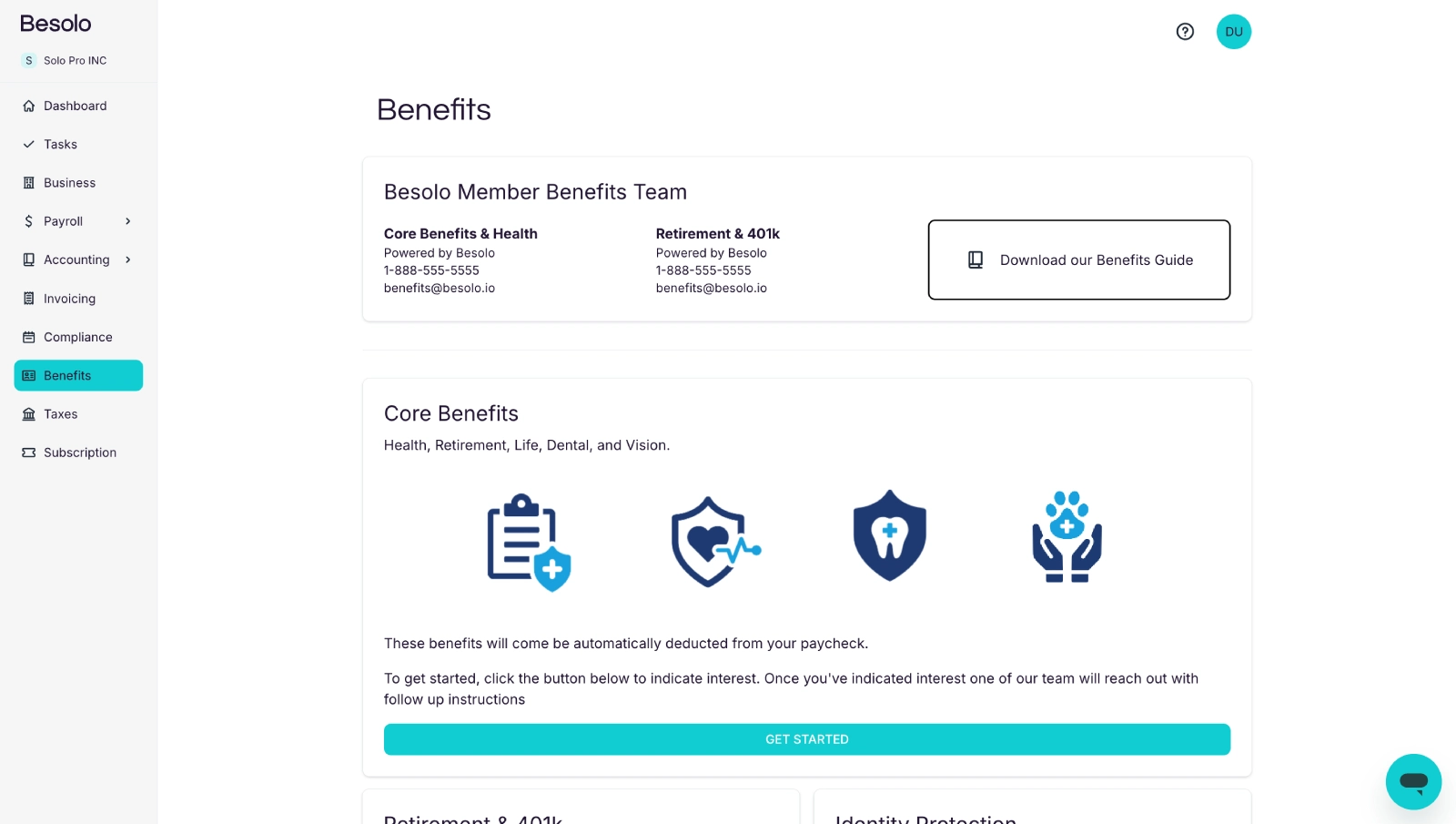

Benefits access

Solo 401K included for all members. Revolutionary access to benefits options for S Corp members including PPO healthcare, dental, life & more.

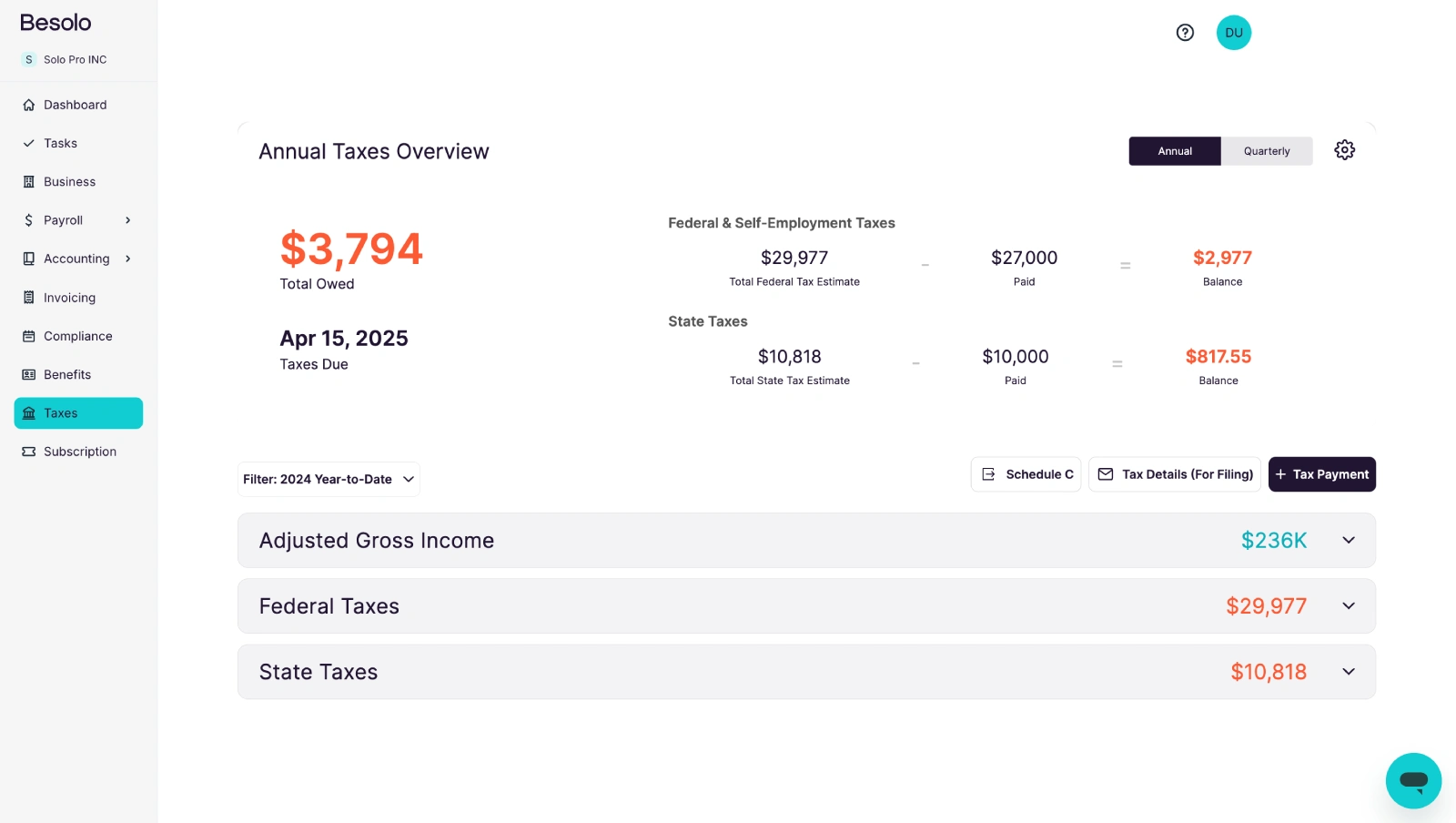

Tax system

A complete tax system built for businesses-of-one. Choose LLC or S Corp depending on your goals, Besolo makes taxes easy.

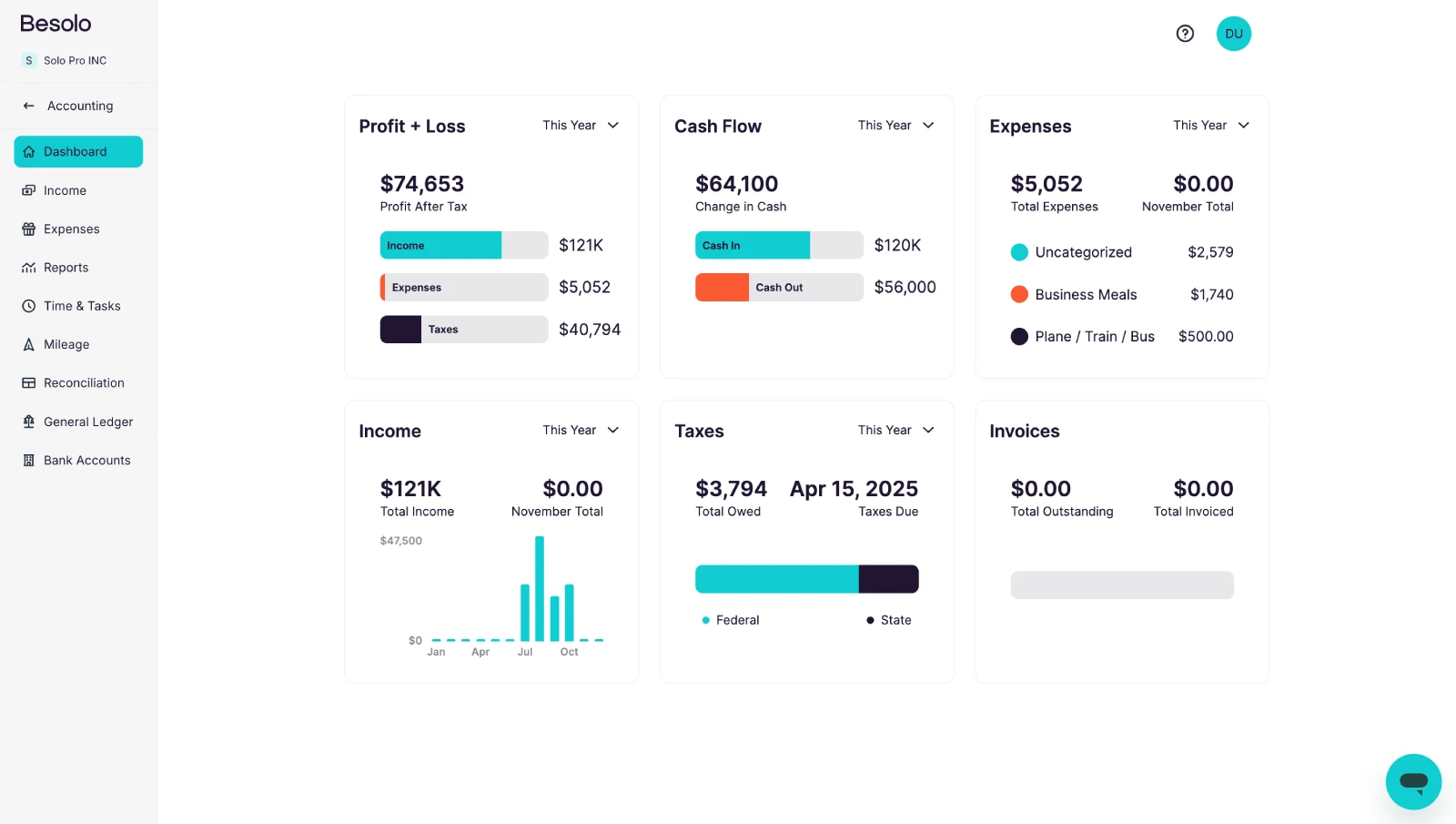

Admin

Cover the most painful company admin tasks in one place with one support team. Company compliance, accounting, time tracking & invoicing.

What our customers say about us

Benefits access

Besolo gives unparralled benefits access to both LLC and S Corp members. We’ve done the hard work of picking what is best for solos and making them easy to turn on as needed.

Choose your path

Tax system

Taxes are one of the most intimidating parts of being a self-employed solo. Besolo makes quarterly estimated and annual taxes easy with licensed tax pros who are all USA-based.

Choose your path

Admin & compliance

Whether its accounting, invoicing or state/federal compliance, Besolo helps handle all the mundane parts of being a solo.

Choose your path

Multiple ways to run your solo business

It’s not one size fits all and can evolve over time. With the Besolo platform you have options and room to grow or shift as your business does.

Solo

LLC

Legal protection, flexibility, low maintenance

$116/month

$129/month

For solos & side hustlers who want protection with flexibility

Solo

S Corp

Everything that an LLC gives + tax savings

$279/month

$349/month

Great for seasoned full-time solos with larger annual income

Multiple ways to

run your solo business

It’s not one size fits all and can evolve over time. With the Besolo platform you have options and room to grow or shift as your business does.

Solo

LLC

Legal protection, flexibility, low maintenance

$116/month

$129/month

Solo

S Corp

Everything that an LLC gives + tax savings

$279/month

$349/month

For solos & side hustlers who want protection with flexbility

Great for seasoned full-time solos with larger annual income

LLC or S Corp – which is right for you?

We’re here to help you navigate the differences between LLC and S Corp. We’ll also let you know how that changes what Besolo can do for you.

Core Besolo features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market

Solo S Corp features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market