Easily Run Your Business of One

All in one benefits, taxes & admin solution for Freelancers|Solopreneurs|Fractionals|Consultants|Independents|Creators

Easily Run Your Business of One

All in one benefits, taxes & admin solution for Freelancers|Solopreneurs|Fractionals|Consultants|Independents|Creators

Besolo is trusted by members of these communities

Are you Solo?

[soh-loh] – noun

1. An independent choosing the path less traveled and building a life of their design. Working how they want, for who they want, and where they want.

Are you a Solo?

[soh-loh] – noun

1. An independent choosing the path less traveled and building a life of their design. Working how they want, for who they want, and where they want.

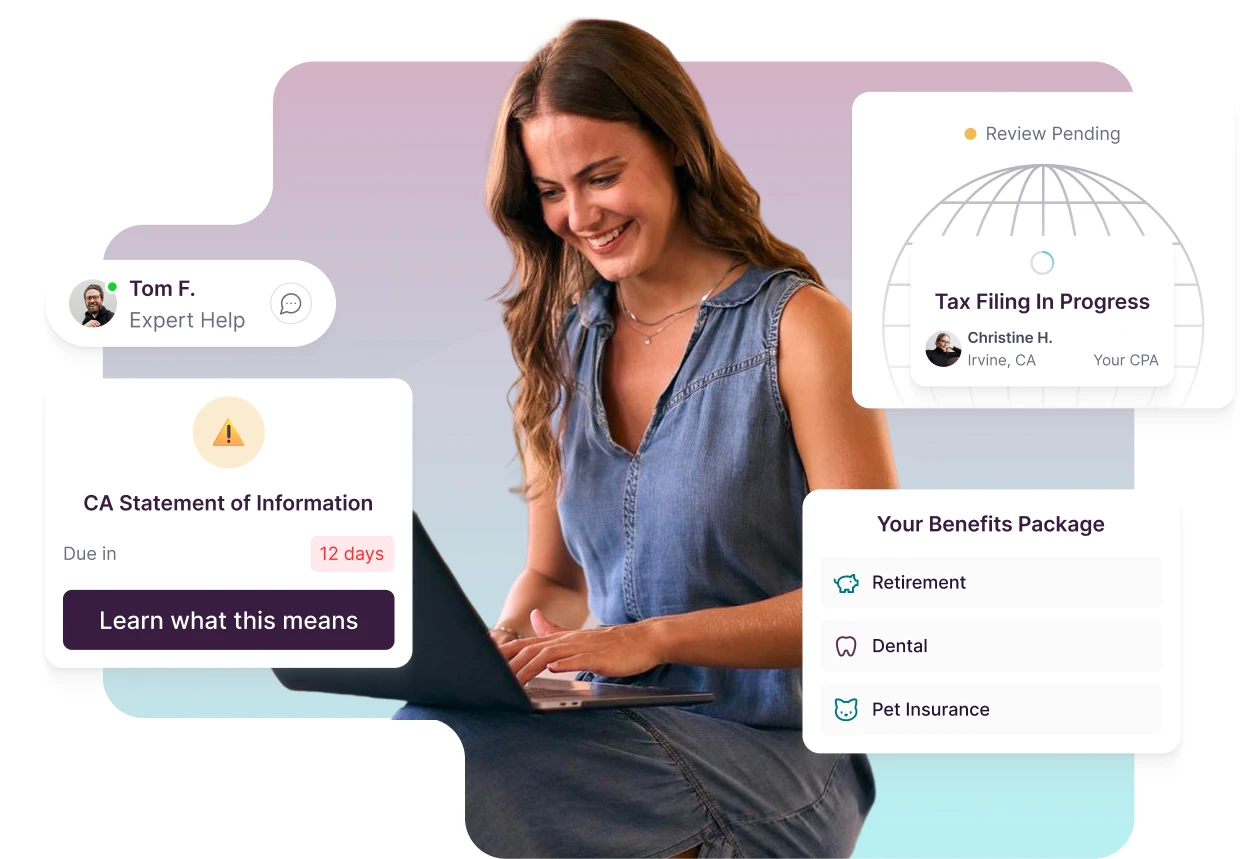

Platform

First all-in-one toolset for Solos

Being a business of one is tough—juggling taxes, admin, compliance, benefits, and retirement with disconnected tools makes it even harder. Besolo’s integrated platform handles the worst parts of independent work.

Guidance & support

Solo, not alone

We are your guides on your solo adventure and always respond within one business day. Having all the tools you need to run your solo business under one roof with one support team means one thing… Relief.

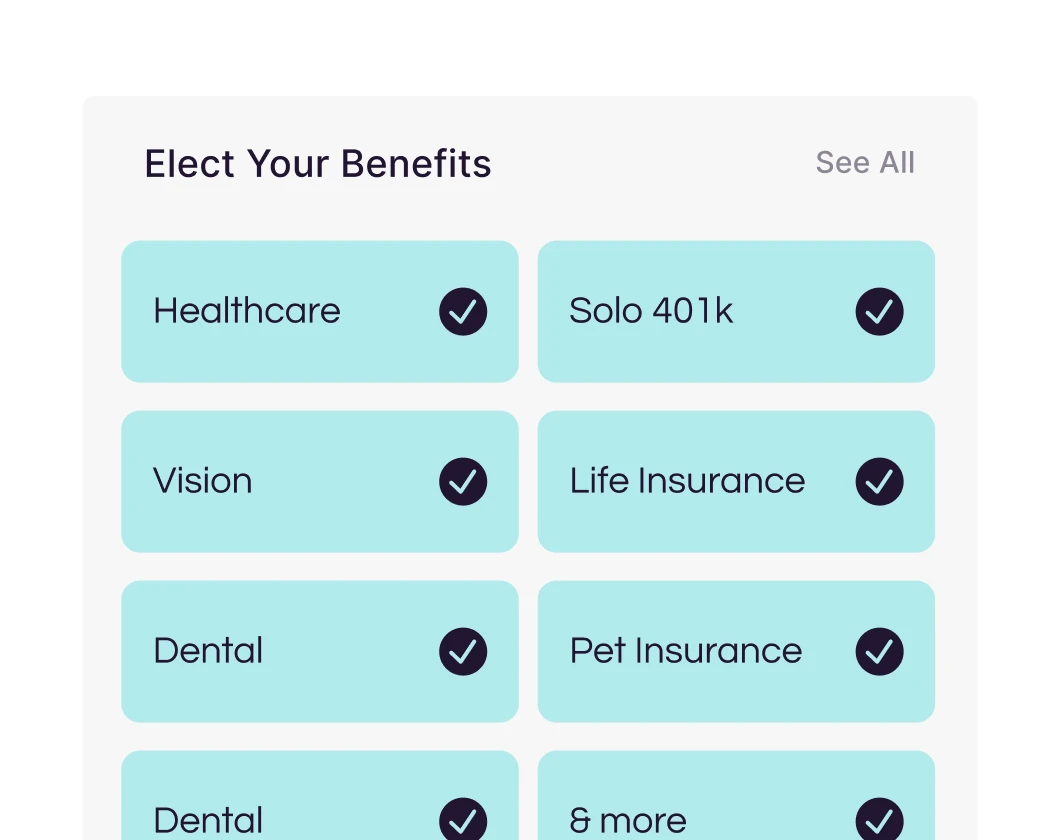

Benefits access

Corporate quality benefits options

One of the biggest challenges of the solo lifestyle is managing essentials like retirement planning, healthcare, and protection against life’s uncertainties. We believe that providing access to benefits is key to supporting a lifelong solo journey.

What our customers say about us

Time is precious as a solo — you need a platform, not another tool

01

Benefits access

All members get a solo 401K. S Corp members enjoy revolutionary options, like PPO healthcare, dental, life insurance & more.

02

Tax system

Tailor made for solo businesses. Choose LLC or S Corp depending on your goals, Besolo makes taxes easy.

03

Admin toolbox

Handle the most painful admin in one place. LLC + S Corp formation, compliance, accounting, time tracking, invoicing & more.

Time is precious as a solo — you need a platform, not another tool

01

Benefits access

All members get a solo 401K. S Corp members enjoy revolutionary options, like PPO healthcare, dental, life insurance & more.

02

Tax system

Tailor made for solo businesses. Choose LLC or S Corp depending on your goals, Besolo makes taxes easy.

03

Admin toolbox

Handle the most painful admin in one place. LLC + S Corp formation, compliance, accounting, time tracking, invoicing & more.

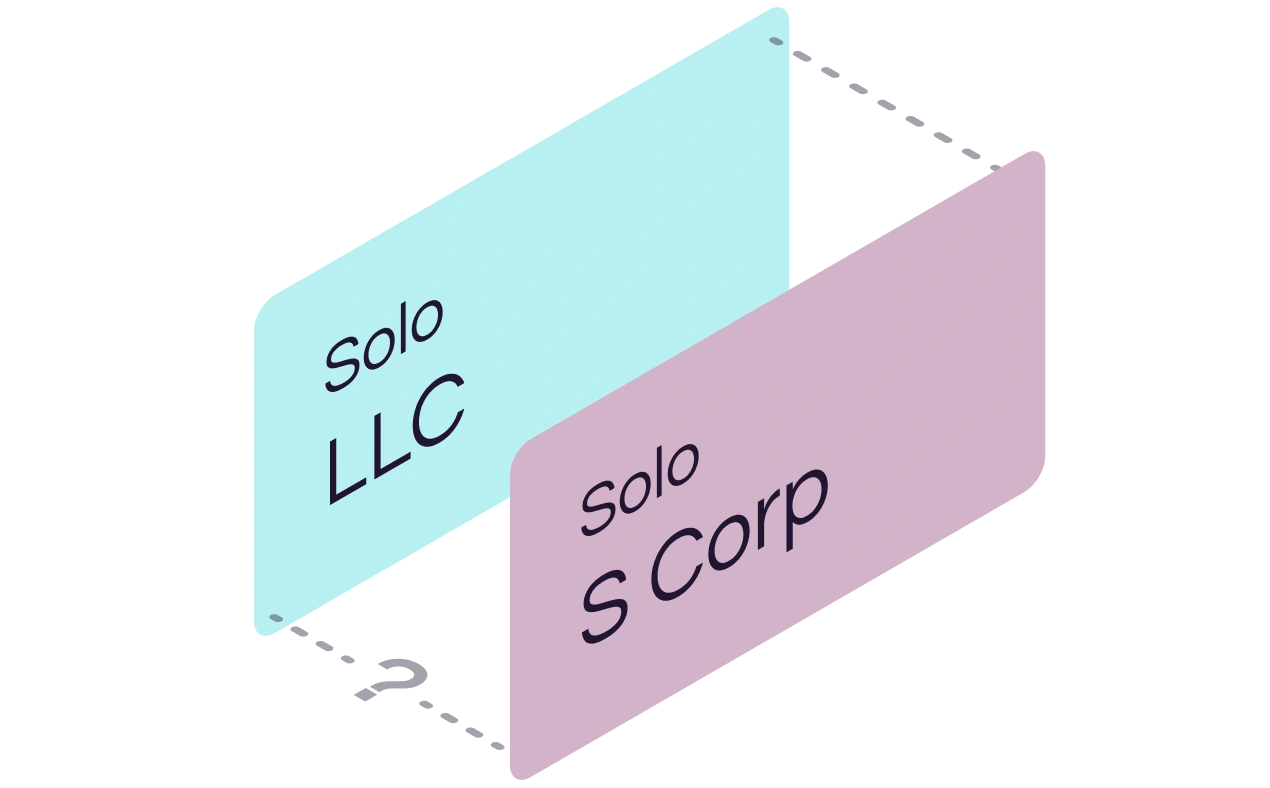

Multiple ways to

run your solo business

It’s not one size fits all and can evolve over time. With the Besolo platform you have options and room to grow or shift as your business does.

Solo

LLC

Legal protection, flexibility, low maintenance

Solo

S Corp

Everything that an LLC gives + tax savings

For solos & side hustlers who want protection with flexbility

Great for seasoned full-time solos with larger annual income

Multiple ways to run your solo business

It’s not one size fits all and can evolve over time. With the Besolo platform you have options and room to grow or shift as your business does.

Solo

LLC

Legal protection, flexibility, low maintenance

For solos & side hustlers who want protection with flexbility

Solo

S Corp

Everything that an LLC gives + tax savings

Great for seasoned full-time solos with larger annual income

LLC or S Corp – which is right for you?

We’re here to help you navigate the differences between LLC and S Corp. We’ll also let you know how that changes what Besolo can do for you.

Besolo mission

We have one life to live, and true independence remains one of the final frontiers of the American Dream. With over a decade of independent experience each, our co-founders built Besolo to empower members across the nation to design the lives they want.

Besolo mission

We have one life to live, and true independence remains one of the final frontiers of the American Dream. With over a decade of independent experience each, our co-founders built Besolo to empower members across the nation to design the lives they want.

Latest posts on the Besolo blog

Common Audit Red Flags Self Employed Taxpayers Miss

Freelancing on the side or full-time means taking charge of your taxes, and small mistakes can lead to big problems…

Sole Proprietor Vs Self Employed – Building an Independent Life

If you’ve started freelancing or consulting on the side, you are technically self-employed, even if you haven’t filed any paperwork.…

Finding the Best Dental Insurance for Self Employed Individuals

Being your own boss has serious advantages, but navigating benefits like dental insurance isn’t always one of them. Without access…

5 Advantages To Being Self Employed That You’re Missing

Thinking about leaving your 9-to-5 for something more flexible, fulfilling, and future-focused? Self-employment isn’t just a backup plan—it’s a smart,…

Self Employed FSA – Understanding the Ins, Outs & Alternatives

You’ve picked up some freelance gigs or started full-time consulting. Can you still open an FSA to save on healthcare…

Solopreneur Vs Entrepreneur Vs Self Employed Explained

Many professionals use the terms solopreneur, entrepreneur, and self-employed interchangeably, but they’re not the same. Each reflects a different mindset, structure,…

Can You Get Disability If You’re Self-Employed? Yes—Here’s How

Disability can disrupt any career, but the impact hits even harder if you’re self-employed. You don’t just lose a paycheck—you…

Self-Employment Tax And Deduction Worksheet Made Simple

When you work for yourself, taxes don’t follow the W-2 playbook. You have more control over reporting income, tracking deductions,…

Navigating Self Employed Maternity Benefits

For self-employed professionals, maternity leave can feel uncertain, but it doesn’t have to be. Without an employer to offer formal…

The Business Owner Vs Self Employed Identity Crisis

If you’ve been freelancing, consulting, or juggling a growing solo practice, you might ask, “Am I running a business, or…