Download the LLC vs. S Corp vs. Sole Proprietor eBook

We believe that every business of one should have an LLC to protect personal assets. From there the choice between LLC & S Corp gets more complicated.

Learn the pros and cons in this eBook, it assumes you are operating as a business of one (no additional owners/employees).

Get the eBook now

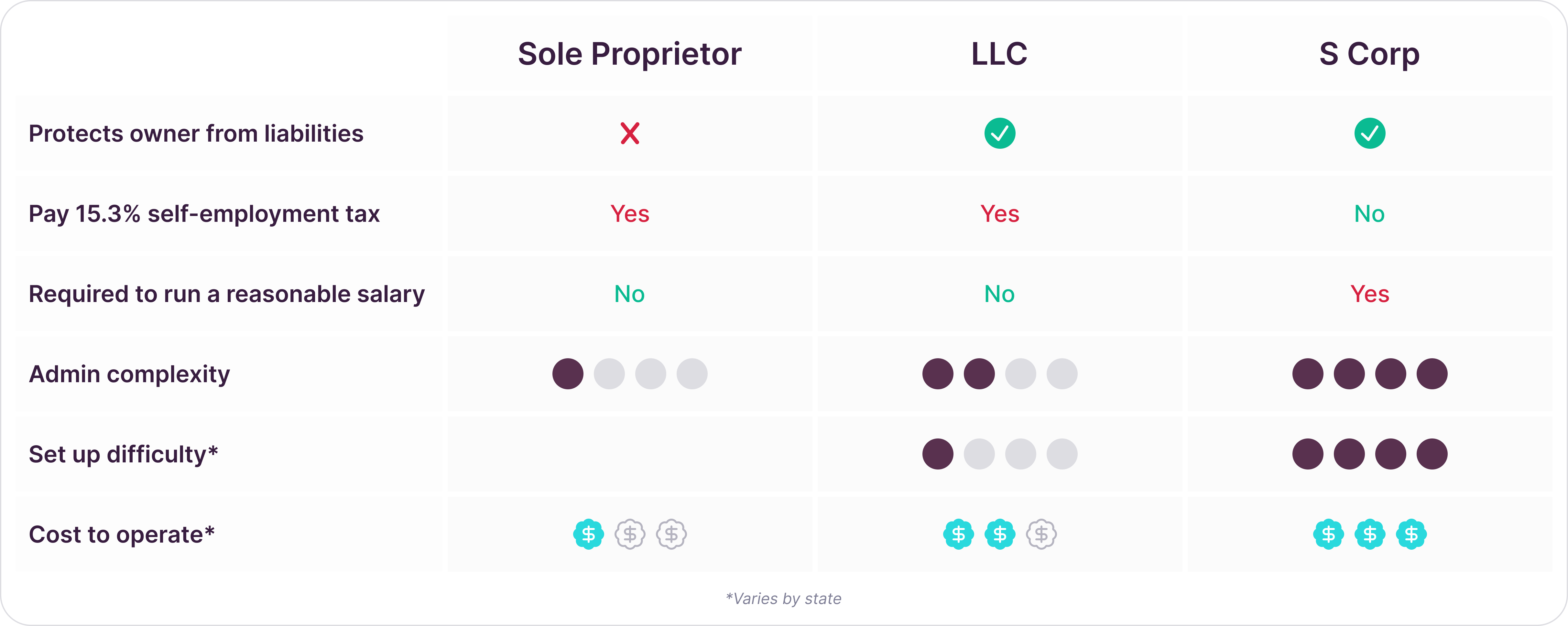

Choosing the correct business structure

Selecting the right business structure is crucial for legal protection, tax benefits, ease of operation, and flexibility. Here is a high level overview, learn more in the eBook. Each option offers unique advantages:

See Besolo yourself

The all-in-one platform for independent professionals

Benefits access

Solo 401K included for all members. Revolutionary access to benefits options for S Corp members including PPO healthcare, dental, life & more.

Tax system

A complete tax system built for businesses-of-one. Choose LLC or S Corp depending on your goals, Besolo makes taxes easy.

Admin

Cover the most painful company admin tasks in one place with one support team. Company compliance, accounting, time tracking & invoicing.

You community gets Besolo for less

Being solo is not one size fits all, but as a partner your members get exclusive discounts on both Besolo core products.

Solo

LLC

Legal protection, flexibility, low maintenance

$116/month

$129/month

For solos & side hustlers who want protection with flexibility

Solo

S Corp

Everything that an LLC gives + tax savings

$279/month

$349/month

Great for seasoned full-time solos with larger annual income

LLC or S Corp – which is right for your members?

We’re here to help Solos navigate the differences between LLC and S Corp. We’ll also let them know how that changes what Besolo can do for them.

Core Besolo features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market

Solo S Corp features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market